portfolio

We’re helping CommBank shape the bank of the future, one venture at a time

There’s a blurring of industry lines happening everywhere. To meet customer needs and expectations, we have to look more broadly than just traditional products and services and really enrich the proposition in aggregate.

Stuart Munro

Group Head of Strategy, CommBank

Our ventures

We're helping CommBank reimagine what it means to be a bank, with products and services that improve people's lives in the moments that matter.

Built and owned

Home-in

2020

Home

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

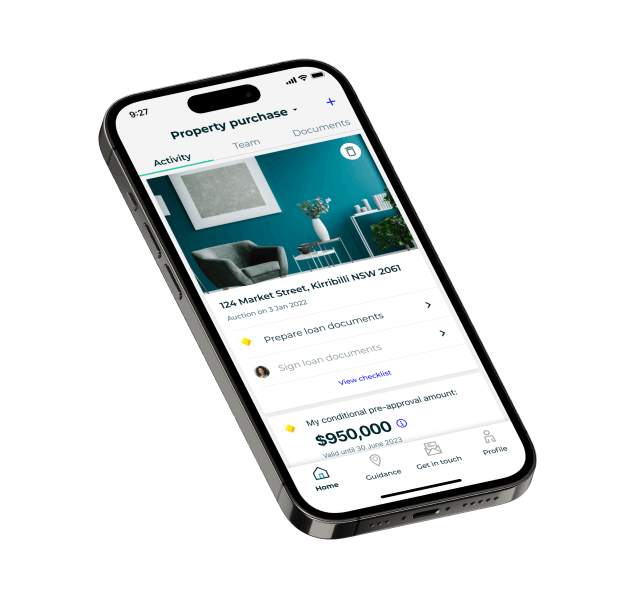

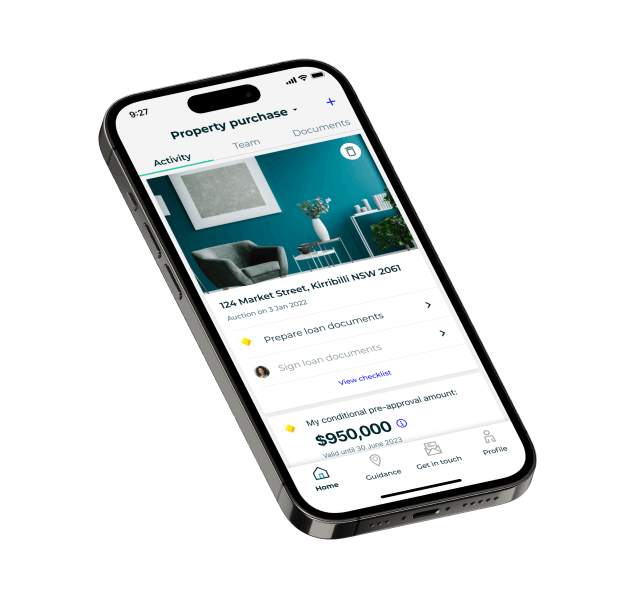

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in

2020

Home

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

Home-in simplifies the complex process of buying a home. It helps buyers navigate the home buying journey and reach settlement with certainty.

CreditSavvy

2020

Everyday

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

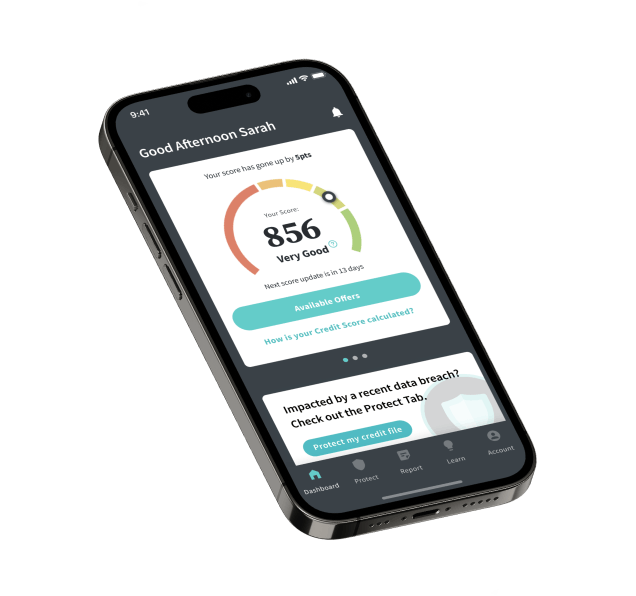

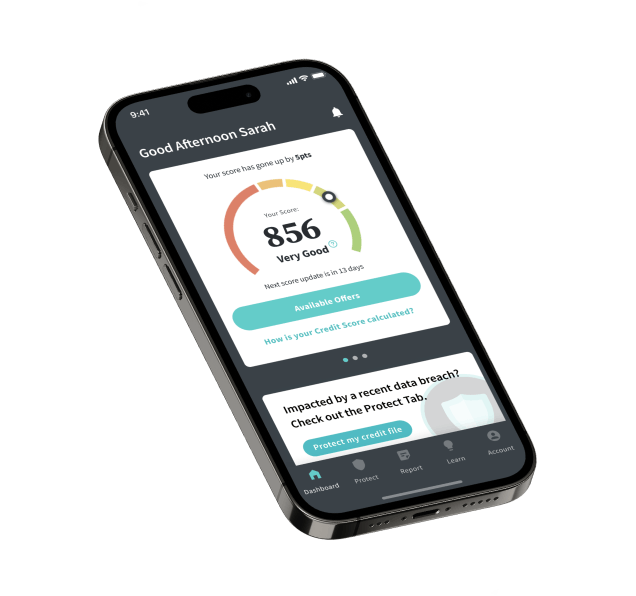

Credit Savvy helps Australians to access, understand and protect their credit reputation.

Credit Savvy helps Australians to access, understand and protect their credit reputation.

CreditSavvy

2020

Everyday

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

CreditSavvy

Credit Savvy helps Australians to access, understand and protect their credit reputation.

Credit Savvy helps Australians to access, understand and protect their credit reputation.

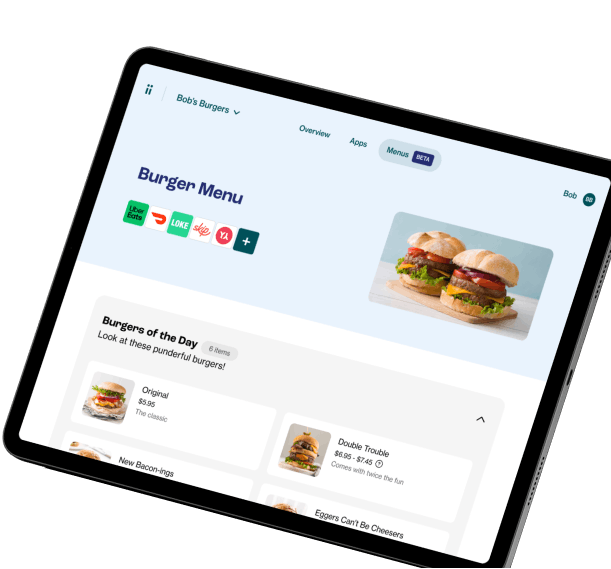

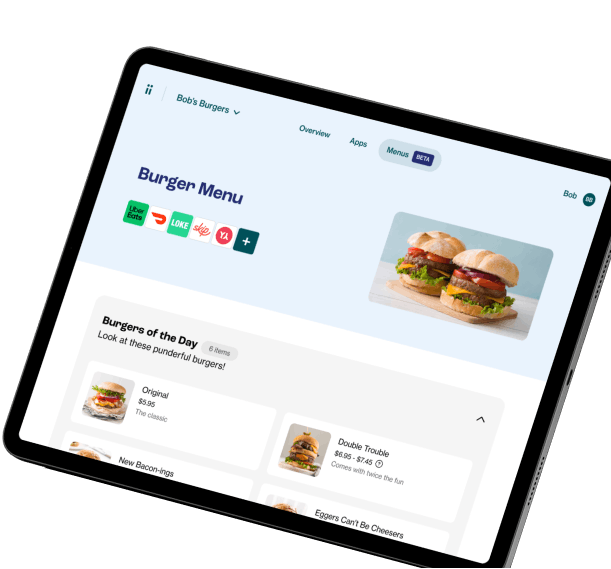

Doshii

2021

Business

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii

2021

Business

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Doshii gets hospitality apps talking to a venue’s POS (point of sale platform), helping business owners spend less of their time on tech, and more on customers.

Unloan

2022

Home

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan

2022

Home

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

Unloan is a new kind of home loan with one great rate, 10-minute application time, and a discount that gets better and better.

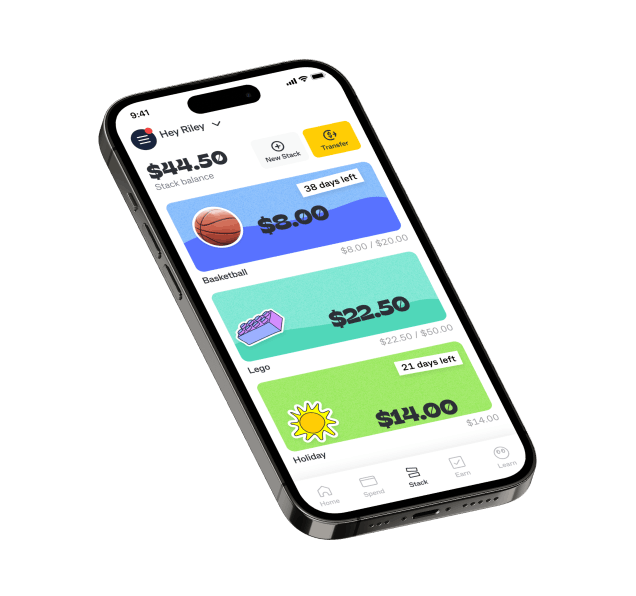

Kit

2022

Everyday

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

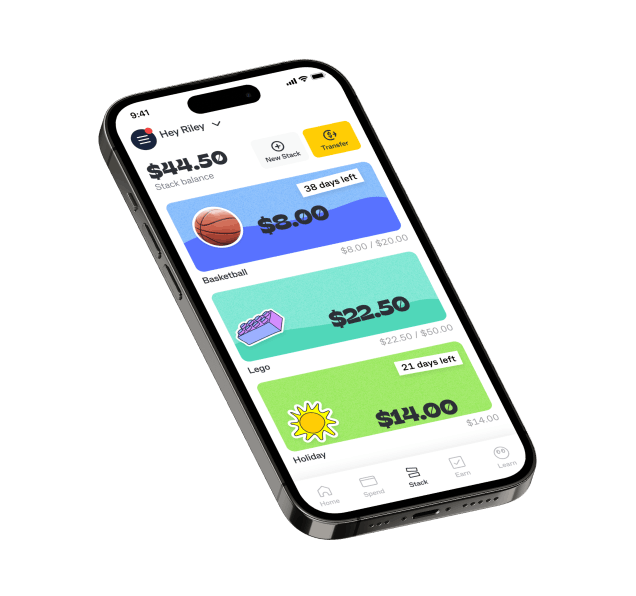

Kit

2022

Everyday

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

Kit is an earning-and-learning, mindfully-spending, money-mastering pocket money app and prepaid card, helping improve the financial capability of young people in Australia.

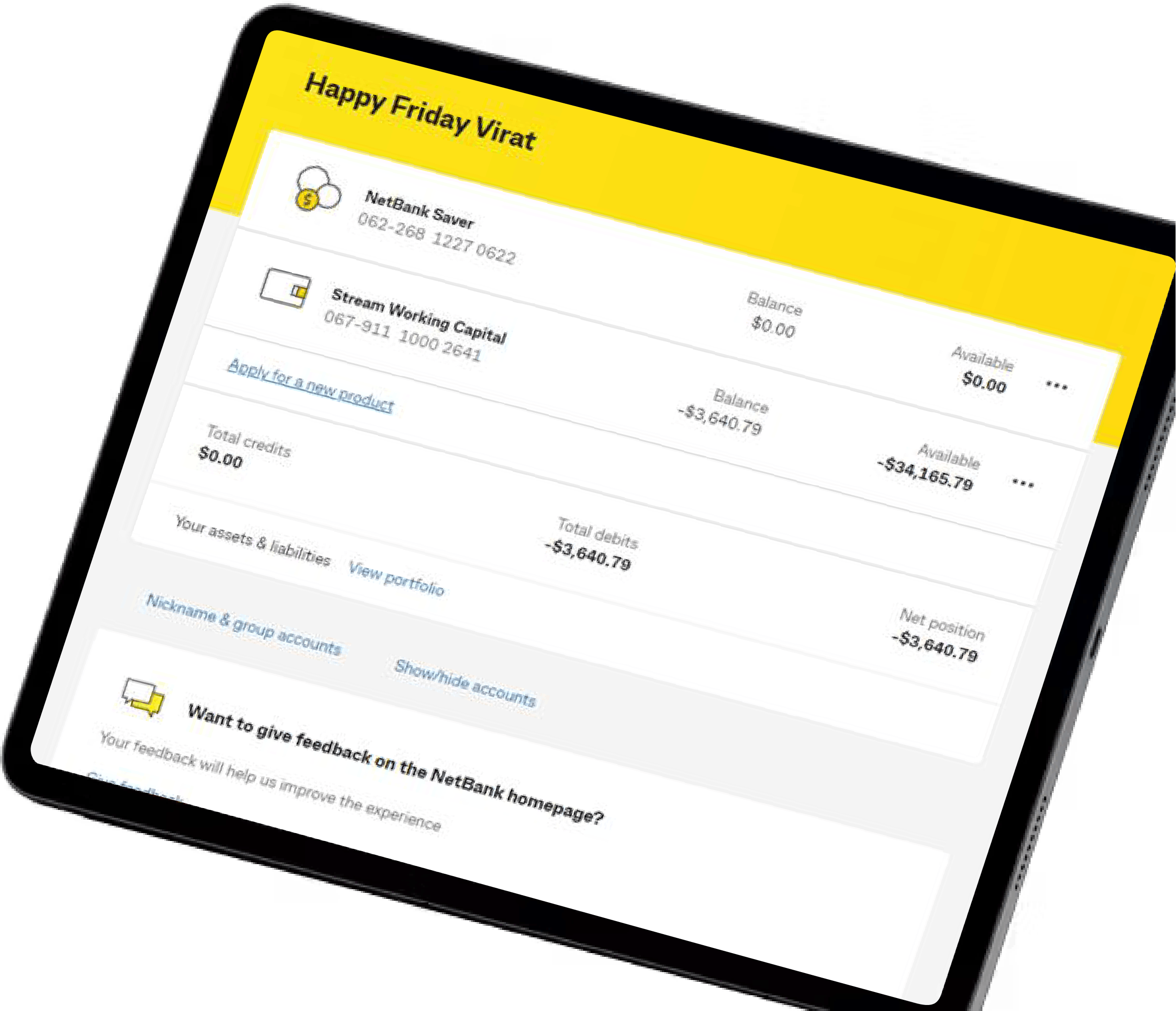

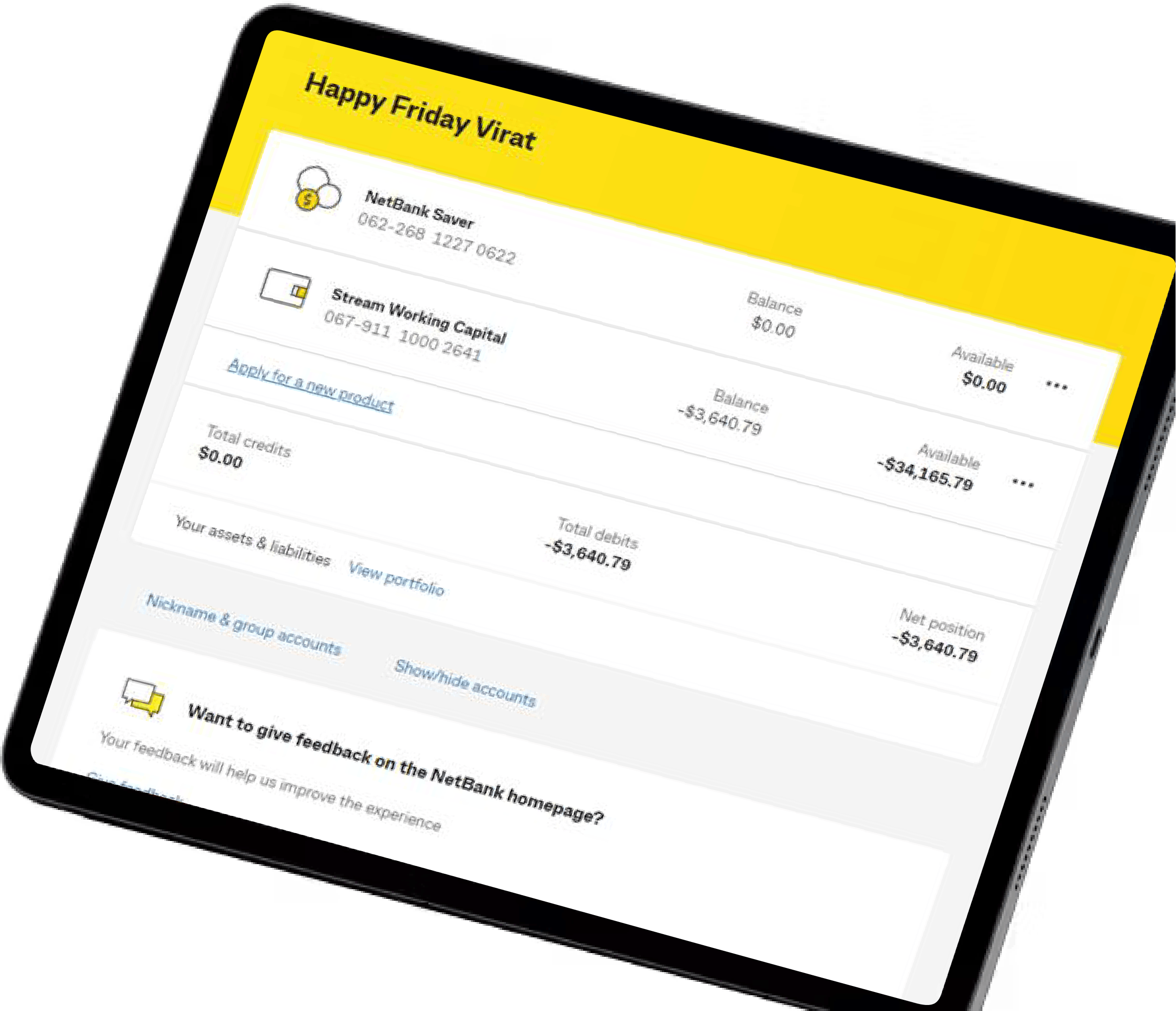

Waddle

2023

Business

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle

2023

Business

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Waddle’s invoice lending platform powers CommBank's Stream Working Capital product, enabling small business owners to unlock cash tied up in unpaid invoices.

Early-stage investments

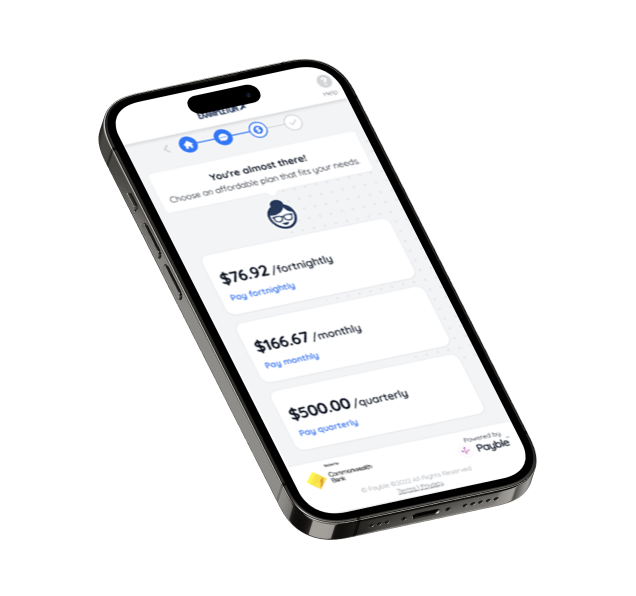

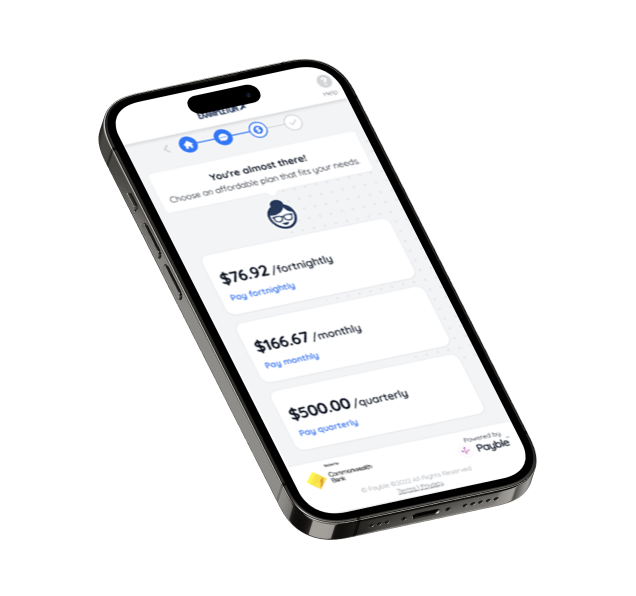

Payble

2021

Everyday

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble is a citizen-centric revenue optimisation platform, helping governments improve revenue outcomes while delivering outstanding citizen payment experiences.

Payble is a citizen-centric revenue optimisation platform, helping governments improve revenue outcomes while delivering outstanding citizen payment experiences.

Payble

2021

Everyday

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble

Payble is a citizen-centric revenue optimisation platform, helping governments improve revenue outcomes while delivering outstanding citizen payment experiences.

Payble is a citizen-centric revenue optimisation platform, helping governments improve revenue outcomes while delivering outstanding citizen payment experiences.

Xccelerate investments

OwnHome

2020

Home

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

OwnHome

2020

Home

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

OwnHome

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

Saving for a deposit is one of the main barriers for potential home buyers. OwnHome is a new pathway to homeownership, without the high upfront costs.

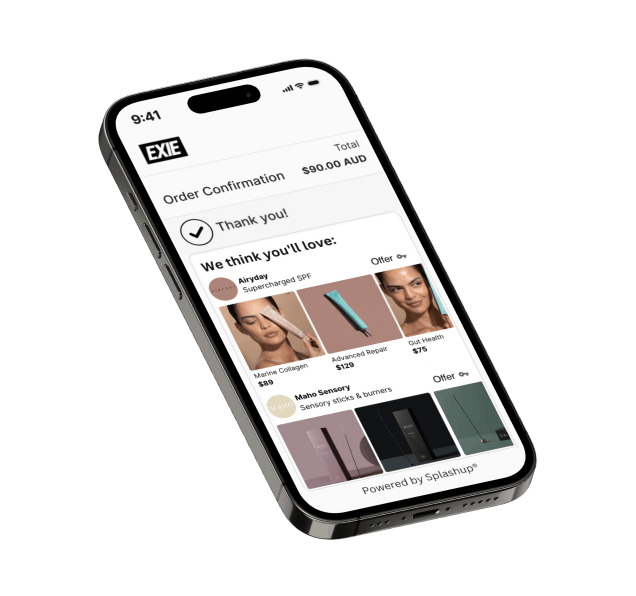

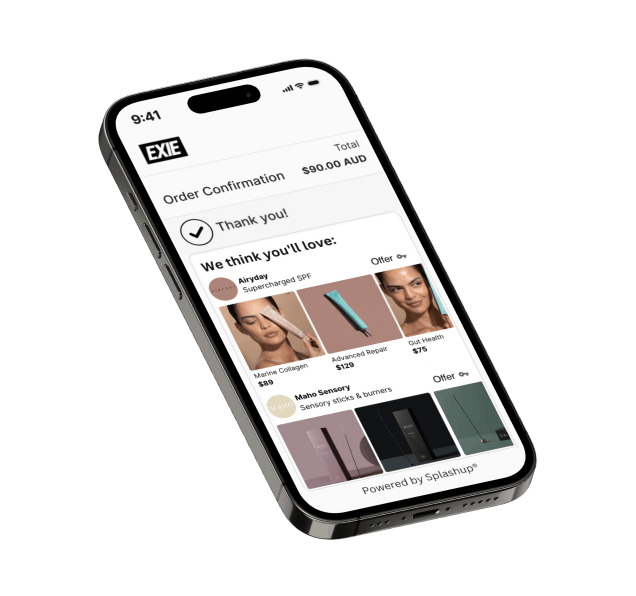

Splashup

2021

Business

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup is an AI-driven partnerships platform, building a network of eCommerce merchants with post-transaction discovery experiences for high-intent shoppers.

Splashup is an AI-driven partnerships platform, building a network of eCommerce merchants with post-transaction discovery experiences for high-intent shoppers.

Splashup

2021

Business

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup

Splashup is an AI-driven partnerships platform, building a network of eCommerce merchants with post-transaction discovery experiences for high-intent shoppers.

Splashup is an AI-driven partnerships platform, building a network of eCommerce merchants with post-transaction discovery experiences for high-intent shoppers.

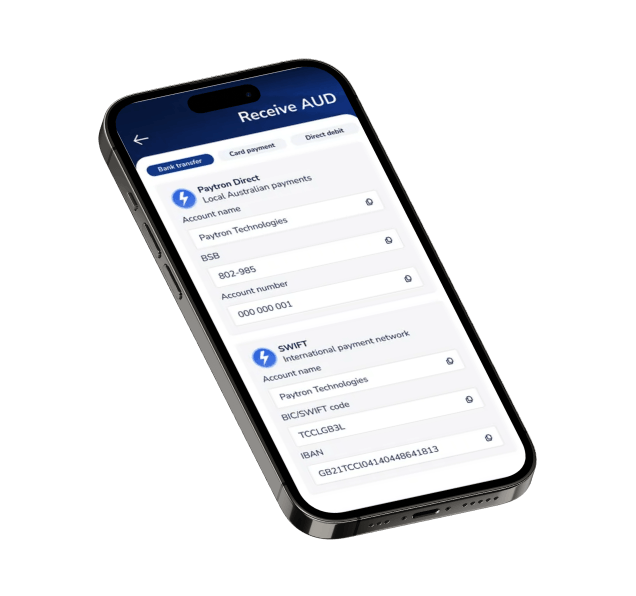

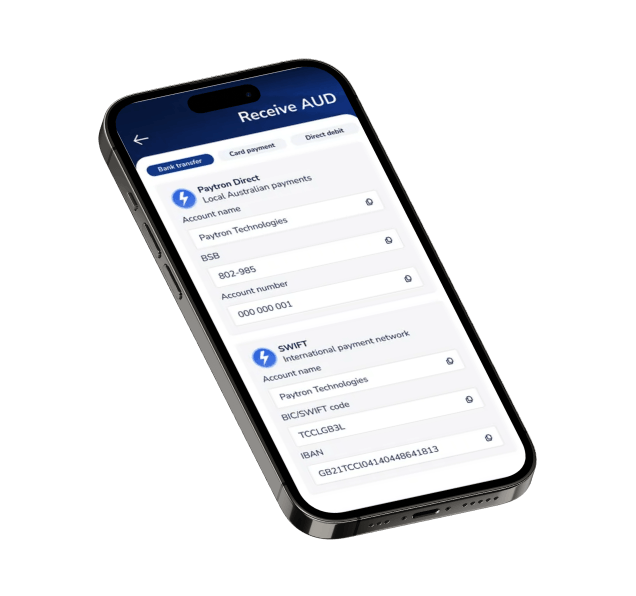

Paytron

2022 (exited 2023)

Business

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron is a payment automation and spend management platform, simplifying the way finance teams manage transactions without a single line of code.

Paytron is a payment automation and spend management platform, simplifying the way finance teams manage transactions without a single line of code.

Paytron

2022 (exited 2023)

Business

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron

Paytron is a payment automation and spend management platform, simplifying the way finance teams manage transactions without a single line of code.

Paytron is a payment automation and spend management platform, simplifying the way finance teams manage transactions without a single line of code.

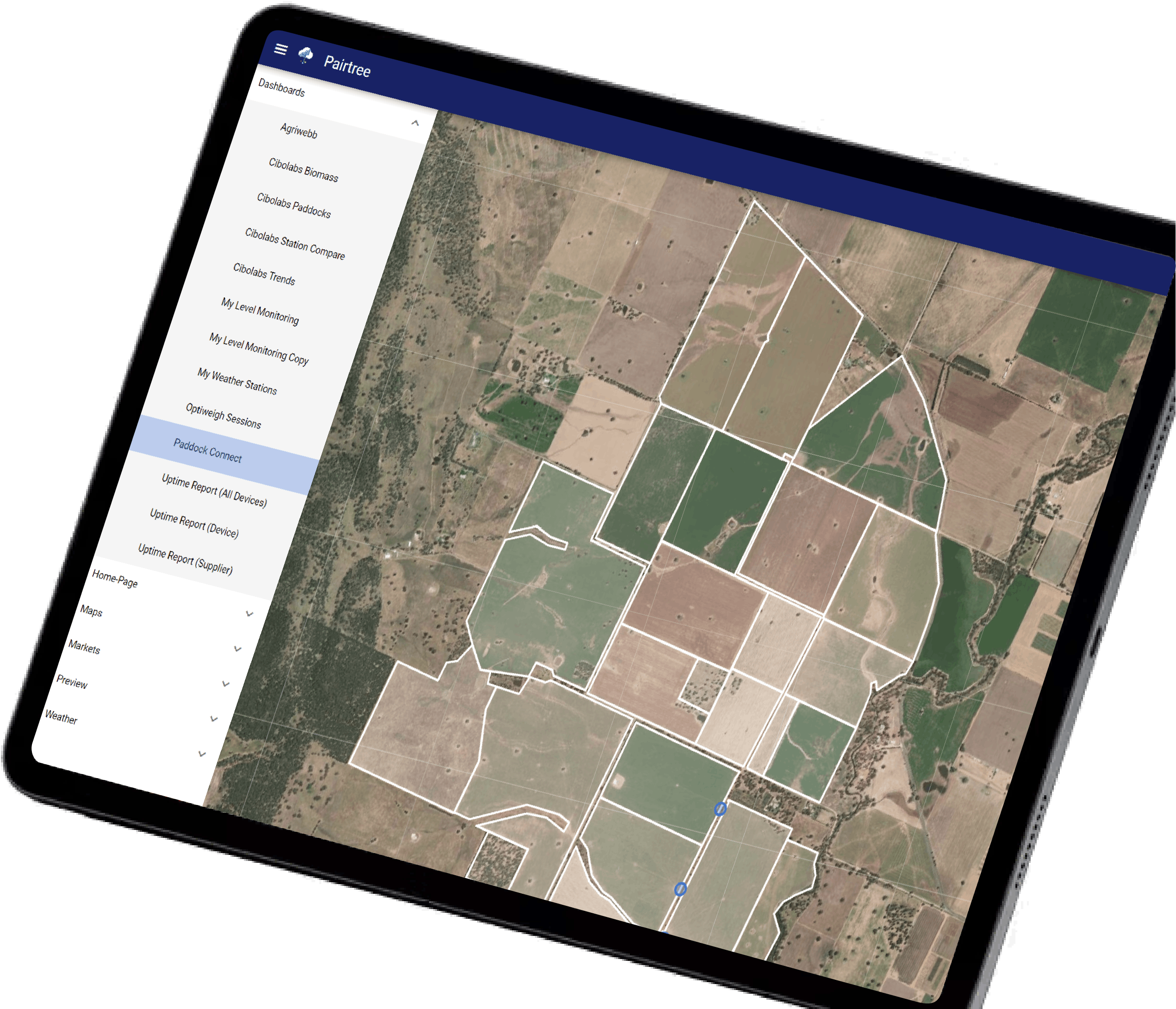

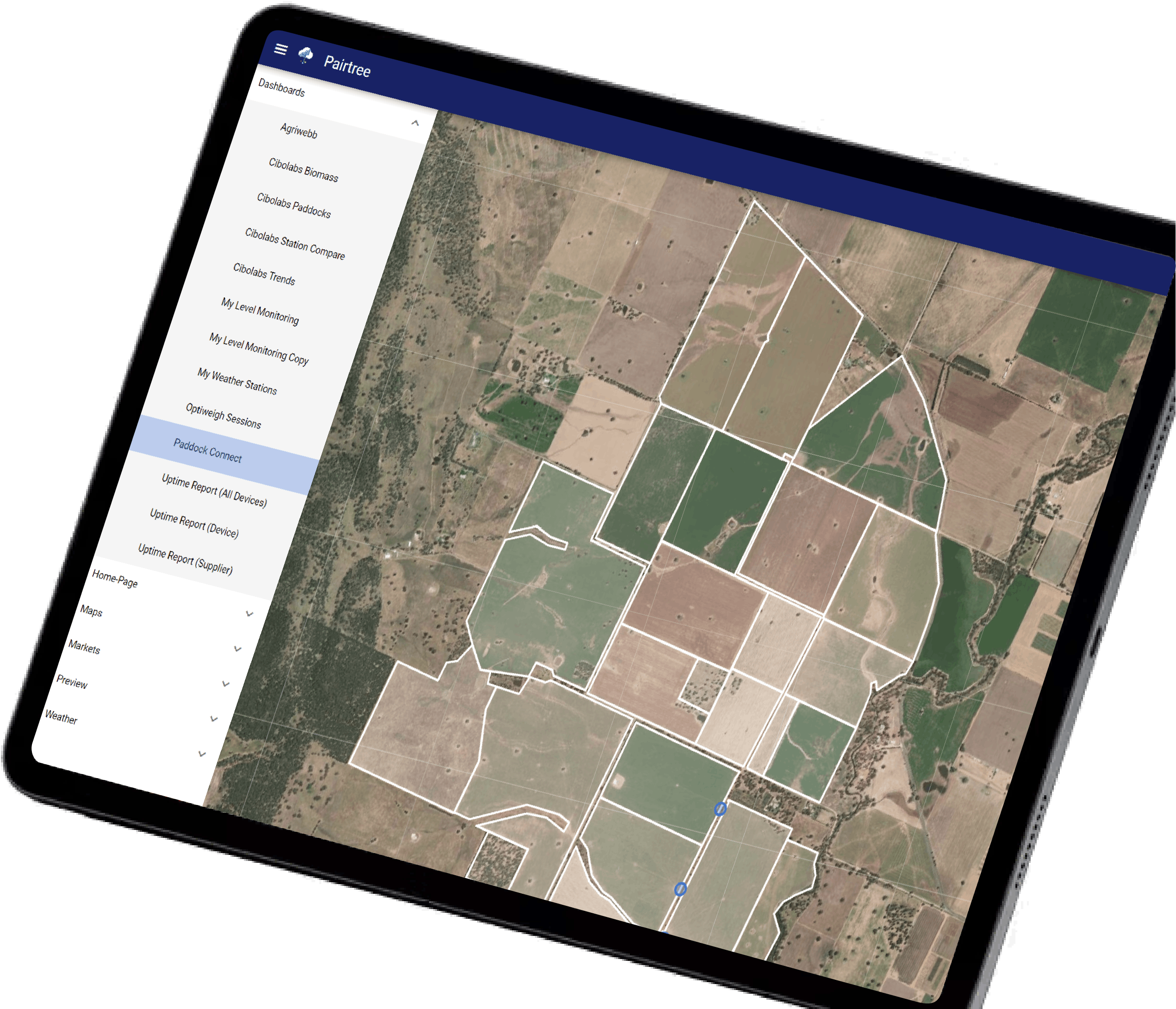

Pairtree

2023

Business

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree

2023

Business

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Pairtree reduces complexity for farmers by centralising 100+ sources of agricultural data into a single platform.

Closed ventures

Unfortunately, not all startups reach scale, and the following ventures have closed:

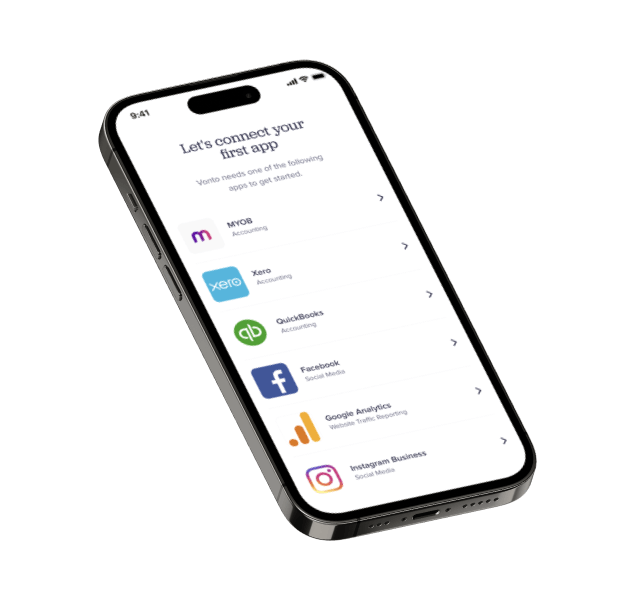

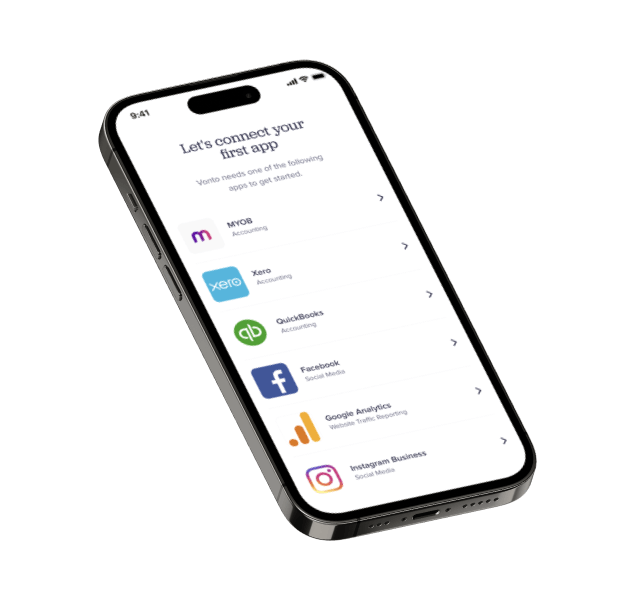

Vonto

2020-2022

Business

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto provided businesses with a feed of useful insights and information they could act on immediately.

Vonto provided businesses with a feed of useful insights and information they could act on immediately.

Vonto

2020-2022

Business

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto

Vonto provided businesses with a feed of useful insights and information they could act on immediately.

Vonto provided businesses with a feed of useful insights and information they could act on immediately.

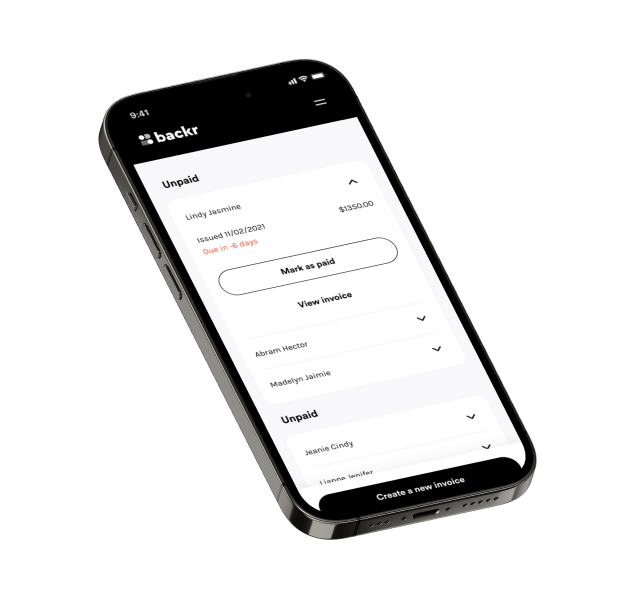

Backr

2020-2022

Business

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr was a digital platform for first-time business owners, which streamlined the process of setting up a business in Australia.

Backr was a digital platform for first-time business owners, which streamlined the process of setting up a business in Australia.

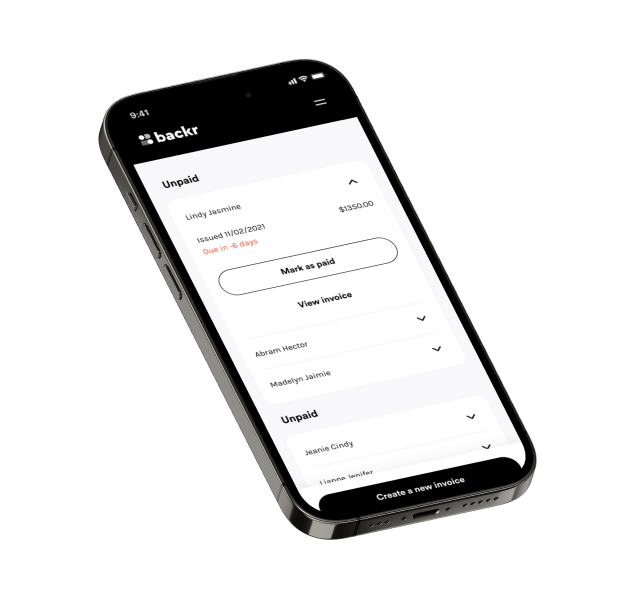

Backr

2020-2022

Business

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr

Backr was a digital platform for first-time business owners, which streamlined the process of setting up a business in Australia.

Backr was a digital platform for first-time business owners, which streamlined the process of setting up a business in Australia.

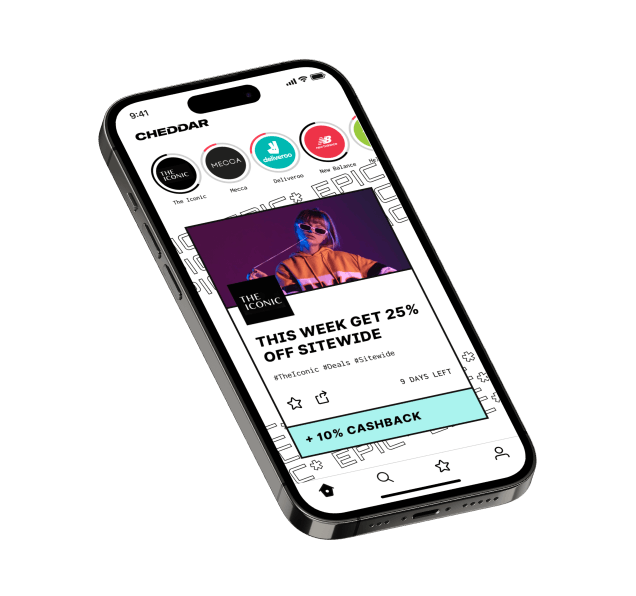

Cheddar

2021-2023

Everyday

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar was a deal discovery and cashback platform, launched to help young Australians get more back from their everyday spending.

Cheddar was a deal discovery and cashback platform, launched to help young Australians get more back from their everyday spending.

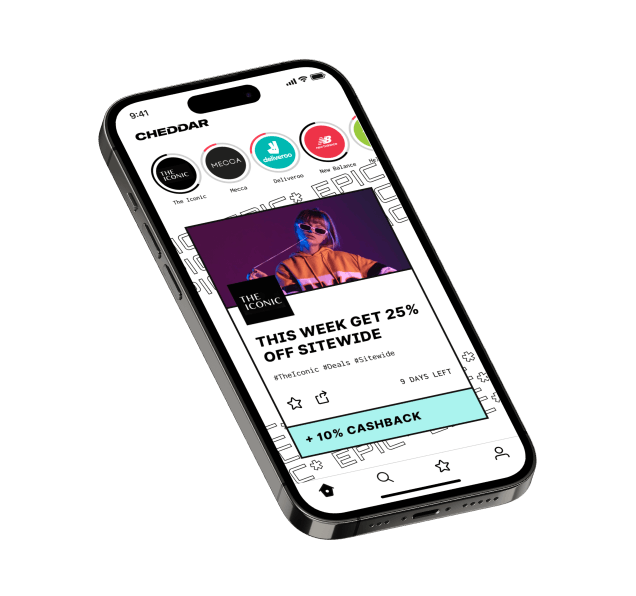

Cheddar

2021-2023

Everyday

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar

Cheddar was a deal discovery and cashback platform, launched to help young Australians get more back from their everyday spending.

Cheddar was a deal discovery and cashback platform, launched to help young Australians get more back from their everyday spending.

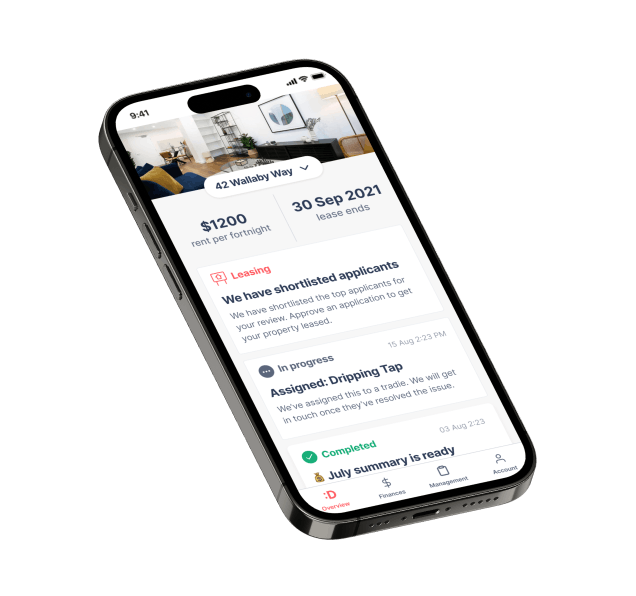

:Different

Closed 2023

Home

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different removed friction from rental properties. For investors and tenants, this meant reliable property management, and for real estate agents, managing and scaling a profitable rent roll.

:Different removed friction from rental properties. For investors and tenants, this meant reliable property management, and for real estate agents, managing and scaling a profitable rent roll.

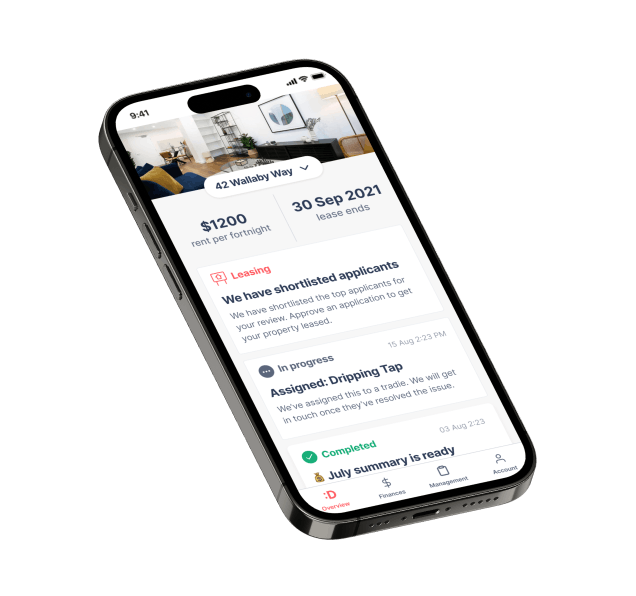

:Different

Closed 2023

Home

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different

:Different removed friction from rental properties. For investors and tenants, this meant reliable property management, and for real estate agents, managing and scaling a profitable rent roll.

:Different removed friction from rental properties. For investors and tenants, this meant reliable property management, and for real estate agents, managing and scaling a profitable rent roll.

© 2023 CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 and Australian Credit Licence 516487, trading as x15ventures. x15ventures is a trade mark of CBA New Digital Businesses Pty Ltd. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia. Please refer to the venture websites for specific venture-related disclosures and other important information. Read our Privacy Policy.

© 2023 CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 and Australian Credit Licence 516487, trading as x15ventures. x15ventures is a trade mark of CBA New Digital Businesses Pty Ltd. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia. Please refer to the venture websites for specific venture-related disclosures and other important information. Read our Privacy Policy.